Solar Module Prices Rise as Soaring Costs Compel Industry-wide Adjustments

The solar photovoltaic (PV) industry is witnessing a significant upward price correction for solar modules, driven primarily by unsustainable cost pressures. Following an extended period of intense competition and declining prices that pushed many players into losses, leading manufacturers are now implementing necessary price increases to restore margins.

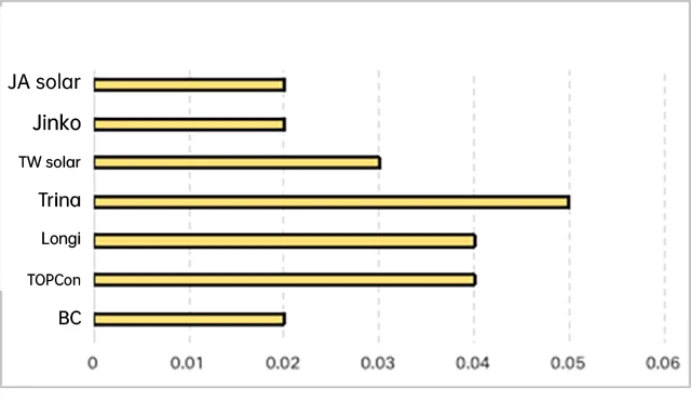

Leading the adjustment, industry giant LONGi and other top-tier solar modules companies have raised prices by approximately 0.03 to 0.05 RMB per watt. This move brings the average offering price for mainstream solar modules to around 0.75 RMB per watt. Analysts confirm this is a direct response to rapidly escalating production costs, with the surge in silver prices being the most prominent factor.

Silver, an essential material for electrical conductivity in PV cells, constitutes a significant portion of module cost. A standard solar module requires 7 to 8 grams of silver. Since the beginning of the year, the spot price of silver has skyrocketed from around 30perouncetoover66 per ounce—more than doubling—directly causing a sharp increase in raw material expenses.

However, the cost pressure is not limited to silver. Prices for other critical materials, including polysilicon, solar glass, and aluminum frames, have also risen steadily, collectively adding to the severe cost burden on manufacturers. Having endured a prolonged price war that eroded profitability, manufacturers now find these simultaneous cost increases untenable, leaving price hikes as the only viable option to alleviate operational pressure.

Downstream buyers, including project developers and distributors, appear to have a relatively higher acceptance of this price adjustment cycle, recognizing that it is driven by external, macro-level factors in the raw material markets rather than manufacturer margins alone.

Industry observers suggest that the current cost structure indicates module prices are likely to remain firm or even increase further in the near term, with a significant downward correction appearing unlikely. The move by major manufacturers is seen as a crucial step toward stabilizing the industry and ensuring sustainable development after a phase of severe margin compression.

Recommendation to Buyers: Given the current cost-driven market dynamics and the likelihood of prices staying elevated, stakeholders with immediate or short-term procurement needs are advised to evaluate their purchasing plans proactively.